Kickstart Your Banking Career with

IBSC’s 100-Day Program

professional certificate program in retail banking

Step into top operational roles in India’s leading banks — with job-ready skills, practical exposure, and expert mentorship.

Fresh Graduates

Learning Enthusiasts

Job Seekers

Aspiring Bankers

Career Changers

Eligibility Requirements

Age requirement

Must be between 21-28 years at the time of enrollment.

CIBIL Score

CIBIL Score (at least 700) or 1 (Further in no case CIBIL should be in High-Risk Category)

Educational qualification

graduate or postgraduates with min 50% marks of any stream.

Academic Gap

Maximum 2-year gap after the last educational qualification.

Work Experience

Candidates with prior work experience are also eligible.

job roles

Cashier/teller

Manage branch cash—deposits, withdrawals, cheque processing. Balance the cash drawer daily, maintain records. Requires numerical accuracy, responsibility, and customer sales/service orientation. Ideal first step into branch operations.

Important information

~5.6 K+

job openings

₹2.75 LPA

Average Salary

Welcome Desk/Customer Service Manager

Serve as the first point of contact for visitors and customers. Manage front-desk operations, greet and assist walk-ins, handle inquiries and appointments, coordinate with internal teams, and ensure a smooth customer experience. Maintain records, manage calls/emails, and resolve issues professionally. Requires strong communication, organization, and customer-focused attitude. Ideal for roles emphasizing service excellence and relationship management.

Important information

~4.2 K+

job openings

₹3.2 LPA

Average Salary

Customer Care Executive

Handle customer inquiries through calls, emails, and chat, providing accurate information and timely support. Resolve complaints, process requests, and ensure high customer satisfaction by following service standards. Maintain customer records, escalate issues when required, and support retention efforts. Requires strong communication skills, problem-solving ability, and a customer-first mindset. Ideal for entry to mid-level roles in customer support and service operations.

Important information

~7.8 K+

job openings

₹2.6 LPA

Average Salary

Virtual Care Officer

Provide remote customer support through calls, video, and digital platforms to address queries, guide users, and resolve concerns efficiently. Monitor service requests, maintain accurate digital records, and coordinate with internal teams to ensure seamless virtual assistance. Requires strong communication skills, tech-savviness, empathy, and the ability to manage customers in a virtual environment. Ideal for roles focused on digital service delivery and remote care operations.

Important information

~3.9 K+

job openings

₹3.0 LPA

Average Salary

Credit Officer

Assess and evaluate loan applications by analyzing financial documents, credit history, and risk factors. Verify customer information, ensure compliance with lending policies, and recommend approvals or rejections. Coordinate with sales and recovery teams, maintain accurate records, and monitor loan performance. Requires strong analytical skills, attention to detail, and knowledge of credit policies. Ideal for roles in banking, NBFCs, and financial services.

Important information

~6.1 K+

job openings

₹3.8 LPA

Average Salary

Virtual-KYC Officer

Conduct customer identity verification remotely through video calls and digital platforms in compliance with regulatory guidelines. Verify documents, authenticate customer details, ensure data accuracy, and flag discrepancies or risks. Maintain proper records, follow KYC/AML norms, and coordinate with compliance teams when required. Requires attention to detail, good communication skills, and familiarity with digital verification processes. Ideal for roles in banking, fintech, and financial services.

Important information

~4.7 K+

job openings

₹3.4 LPA

Average Salary

Phone Banking Officer

Assist customers over the phone with banking services such as account inquiries, transactions, service requests, and issue resolution. Provide accurate information on products, ensure compliance with banking policies, and maintain confidentiality of customer data. Handle complaints professionally, escalate when required, and support customer retention. Requires strong communication skills, problem-solving ability, and a customer-centric approach. Ideal for roles in banks and financial service institutions.

Important information

~5.5 K+

job openings

₹3.2 LPA

Average Salary

Process Associate – KYC/AML

Support compliance operations by performing customer due diligence, KYC verification, and AML checks as per regulatory guidelines. Review and validate customer documents, monitor transactions for suspicious activity, flag risks, and maintain accurate records. Coordinate with compliance and operations teams to ensure timely processing and adherence to policies. Requires attention to detail, basic knowledge of KYC/AML norms, and strong analytical skills. Ideal for roles in banking, fintech, and financial services.

Important information

~6.8 K+

job openings

₹3.1 LPA

Average Salary

Relationship Officer

Build and maintain strong relationships with customers by understanding their financial needs and offering suitable products and services. Act as a key point of contact, handle queries, support account management, and ensure customer satisfaction. Coordinate with internal teams to drive sales, retention, and service excellence. Requires good communication skills, interpersonal ability, and a customer-focused approach. Ideal for roles in banking, NBFCs, and financial services.

Important information

~7.2 K+

job openings

₹3.6 LPA

Average Salary

Customer Care / Service Executive (NBFC)

Handle customer inquiries related to loans, repayments, account details, and service requests through calls, emails, and digital channels. Resolve complaints, guide customers on NBFC products and processes, and ensure timely follow-ups. Maintain accurate records, adhere to compliance guidelines, and coordinate with internal teams for smooth service delivery. Requires strong communication skills, problem-solving ability, and basic knowledge of NBFC operations. Ideal for roles in non-banking financial companies focused on customer support and service excellence.

Important information

~5.9 K+

job openings

₹3.0 LPA

Average Salary

Junior Relationship Executive (NBFC)

Support relationship management by assisting customers with loan products, account queries, and service requests. Build rapport with clients, follow up on leads, ensure timely documentation, and coordinate with internal teams to deliver smooth service. Help maintain customer satisfaction and retention while adhering to NBFC policies and compliance norms. Requires good communication skills, basic financial knowledge, and a customer-oriented approach. Ideal for entry-level roles in non-banking financial companies.

Important information

~4.8 K+

job openings

₹2.8 LPA

Average Salary

Virtual Relationship Manager (Bank)

Manage and nurture customer relationships through digital channels such as phone, video, and online platforms. Understand customer financial needs, offer suitable banking products, resolve service issues, and ensure a seamless virtual banking experience. Coordinate with internal teams, track customer interactions, and drive engagement and retention while complying with banking policies. Requires strong communication skills, digital proficiency, and a customer-centric approach. Ideal for roles in modern, tech-enabled banking environments.

Important information

~3.6 K+

job openings

₹4.2 LPA

Average Salary

Why Choose IBSC?

Job-Aligned

Curriculum

Our 100-day flagship program is developed with direct input from banking veterans to match the real demands of operational roles.

Live, Interactive

Learning

Training that mirrors real-world operations, from cash handling to complaint resolution. Students gain practical experience before stepping into a bank.

Practical, Job-Ready

Skills

All classes are 100% live and led by former bankers with 10–30 years of BFSI experience. Learners benefit from real-time doubt resolution, case-based teaching, and deep industry insights.

Dedicated Placement

Support

Our in-house Placement Cell provides resume guidance, aptitude training, mock interviews, and access to 5+ exclusive placement drives with top banks and NBFCs.

Alumni Placed in

Leading banks

Our graduates work with HDFC Bank, Kotak Mahindra Bank, Axis Bank, IDFC First Bank, Bandhan Bank and many more. We also offer post-placement mentoring and career progression support to help you grow after landing your first job.

Affordable and

Accessible for all

Our program is priced to be accessible for fresh graduates and government exam aspirants, with flexible payment plans and EMI options—delivering exceptional ROI for your career.

Module 1: Core Banking Concepts

Module 1: Core Banking Concepts

Important information

Module 1:

Core Banking Concepts

Introduction to Banking

- Indian Financial Sector Overview

- Retail Banking Fundamentals

- Regulatory Framework & Compliance

- Government Schemes & Financial Inclusion

Important information

Module 1:

Core Banking Concepts

Retail Banking Operations

- Banker-Customer Relationship & KYC/AML Guidelines

- Account Opening, Cash & Cheque Operations

- Digital Transactions: RTGS, NEFT, UPI, IMPS

Important information

Module 1:

Core Banking Concepts

Banking Products & Services

- Deposit & Loan Products (NRI & Domestic)

- Mutual Funds, Insurance & Wealth Management

- Compliance & Risk Considerations in Product Design

Important information

Module 1:

Core Banking Concepts

Banking Sales & Customer Acquisition

- Sales Strategies & Customer Onboarding

- Cross-Selling, Up-Selling & Brand Building

- Marketing & Retention Strategies

Important information

Module 1:

Core Banking Concepts

Customer Service & Complaint Handling

- CRM in Banking & Customer Profiling

- Effective Complaint Resolution & Grievance Redressal

Important information

Module 1:

Core Banking Concepts

Digital Banking & Fintech

- Mobile Banking, Fintech Trends & AI in Banking

Important information

Module 1:

Core Banking Concepts

Risk & Compliance Management

- RBI Guidelines, Credit & Operational Risk

- Consumer Protection Laws & Fraud Prevention

Module 2: Employability & Soft Skills

Module 2: Employability & Soft Skills

Important information

Module 2:

Employability & Soft Skills

- Resume Building & Interview Preparation

- Communication & Business Etiquette

- Leadership, Time Management & Conflict Resolution

Module 3: Life Skills & Personal Development

Module 3: Life Skills & Personal Development

Important information

Module 3:

Life Skills & Personal Development

- Emotional Intelligence

- Goal Setting

Module 4: Excel for Banking Professionals

Module 4: Excel for Banking Professionals

Important information

Module 4:

Excel for Banking Professionals

- Advanced Excel, Financial Modeling & Reporting

Module 5: Finacle – Core Banking Solution

Module 5: Finacle – Core Banking Solution

Important information

Module 5:

Finacle – Core Banking Solution

- Practical Training in Financial for Banking Operations

Module 6: Industry Exposure & Certification

Module 6: Industry Exposure & Certification

Important information

Module 6:

Industry Exposure & Certification

- Case Studies & Guest Lectures by BFSI Leaders

- Final Project & Examination for Certification

Our Top Mentors

Our trainers at IBSC are experts with real world experience. They make learning easy and interesting for all students.

Jaspal Singh

Founder | 24+ years

Retail Banking – Assets and Liabilities

Ex-Vice President,

Kotak Mahindra Bank Ltd.

Gurpreet Singh

Co-Founder | 26+ years

TechnoBanker, Learning & Development

Ex-Vice President,

HDFC Bank Ltd.

Surender Singh Ranga

Banking Trainer | 25+ years

Retail Branch Banking

Ex-Vice President,

Axis Bank Ltd.

Apoorva Bhatnagar

Banking Trainer | 10+ years

Retail Branch Banking

Ex-Manager,

The Karur Vysya Bank

Richa Agarwal

Banking Trainer | 15+ years

Retail Banking

Ex-AGM,

IDBI Bank

Shalini Kapoor

Banking Trainer | 18+ years

Retail Banking Operations

Ex-Manager,

Kotak Mahindra Bank Ltd.

Pankaj Chib

Banking Trainer, 26+ years

Retail Branch Banking

Ex-Assistant Vice President,

HDFC Bank Ltd.

Vikas Sofat

Banking Trainer | 23+ years

Retail Banking- Liabilities and Sales

Ex-Senior Vice President

,

Axis Bank Ltd.

Our Top Mentors

Our trainers at IBSC are experts with real world experience. They make learning easy and interesting for all students.

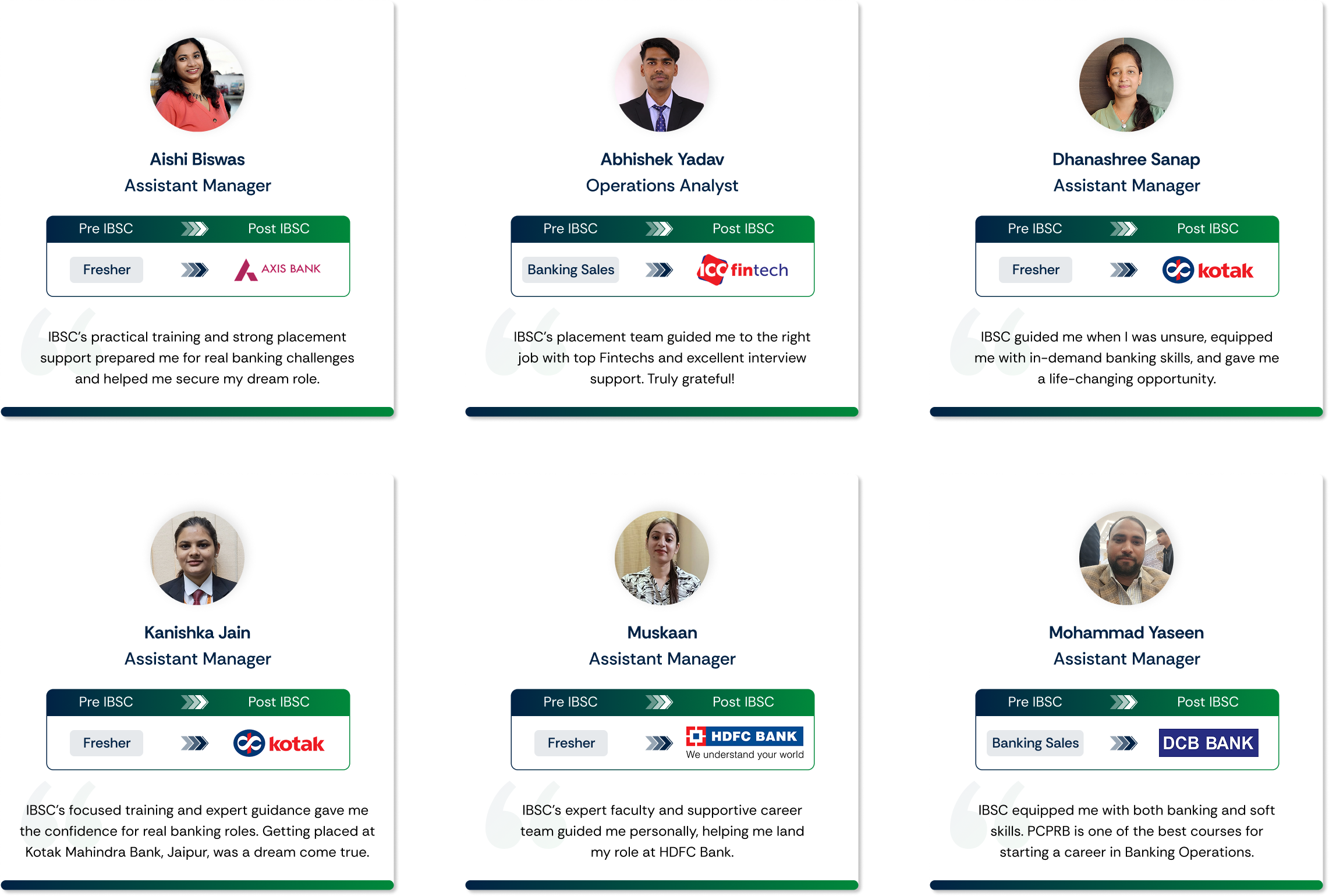

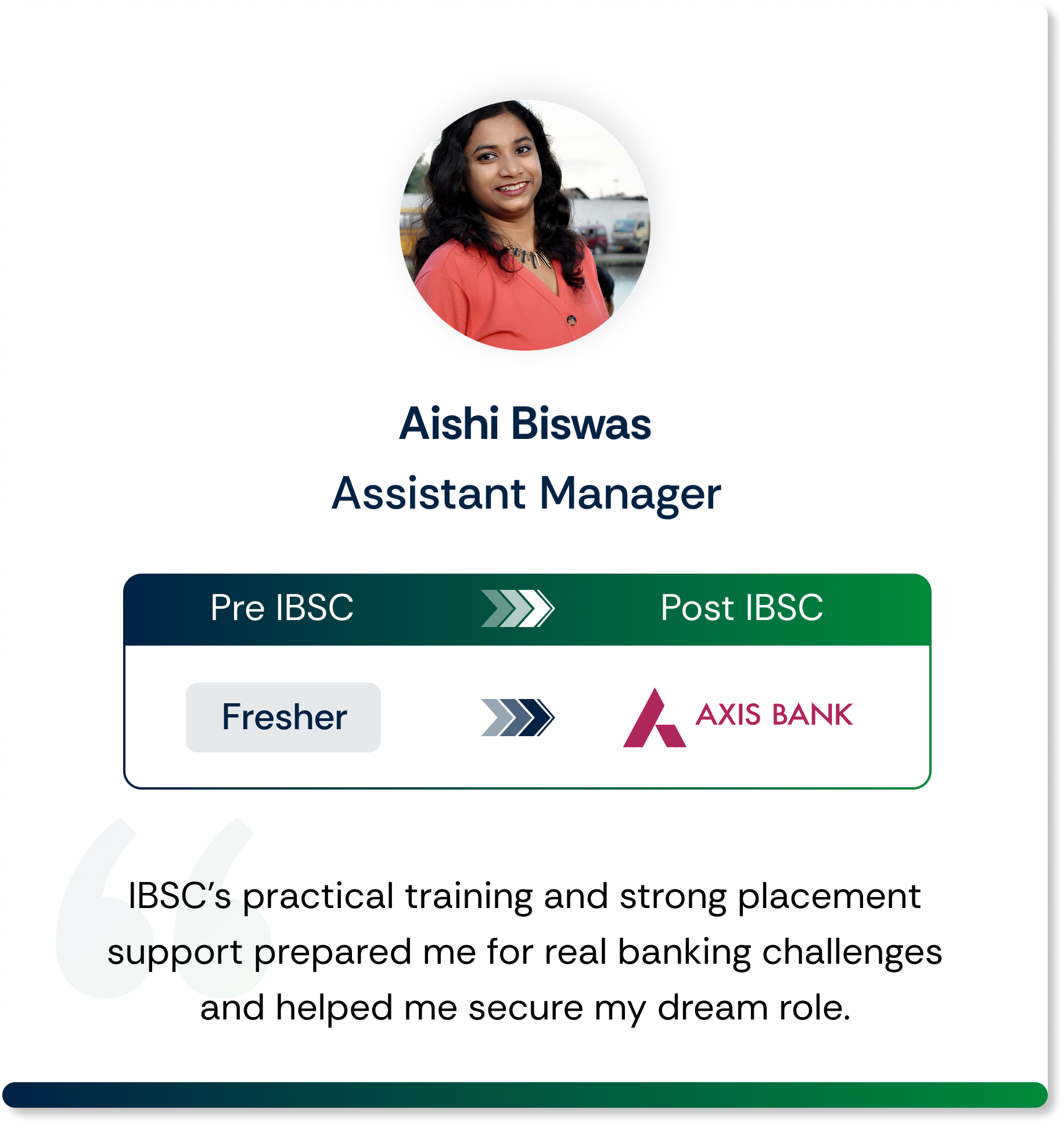

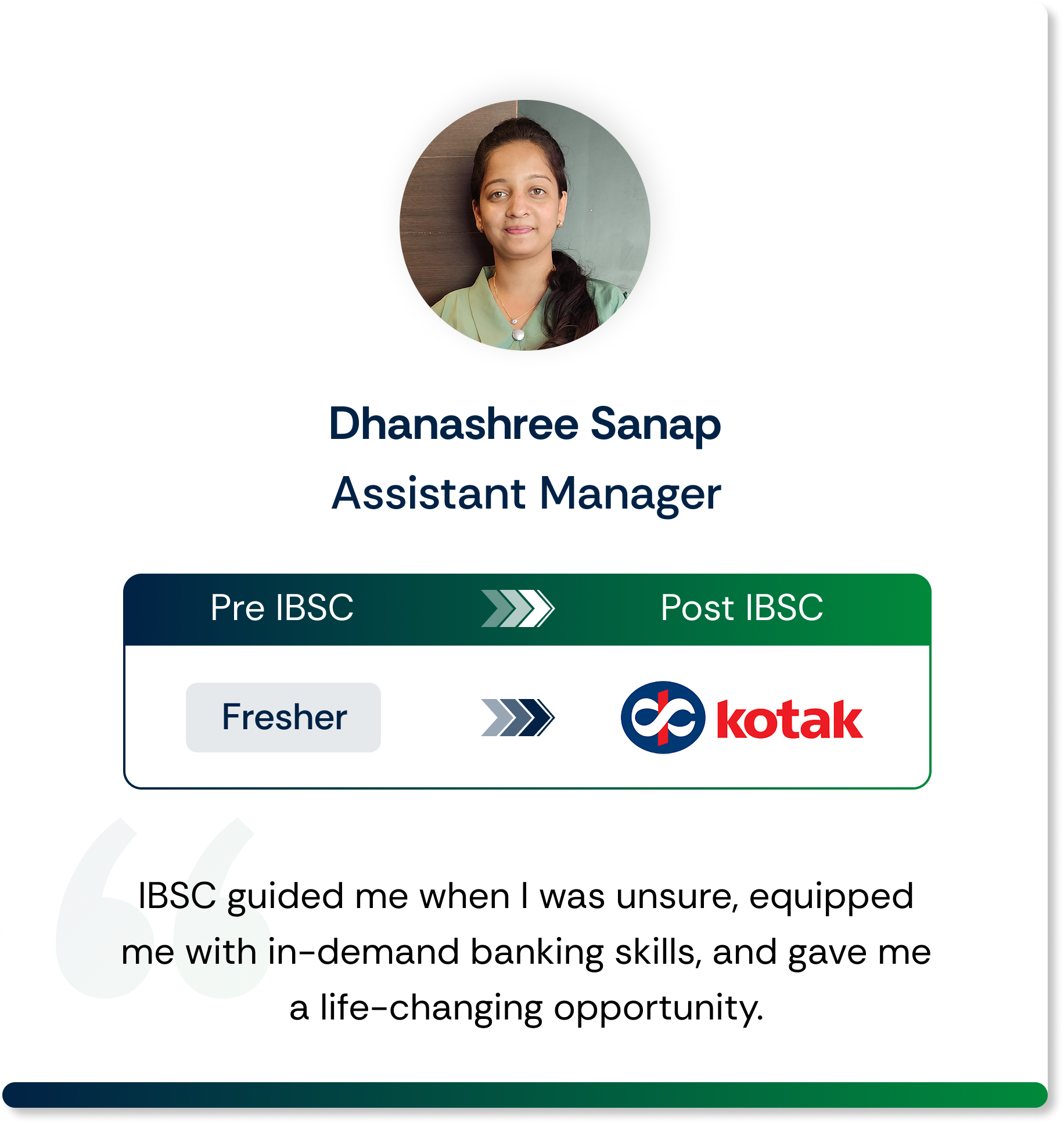

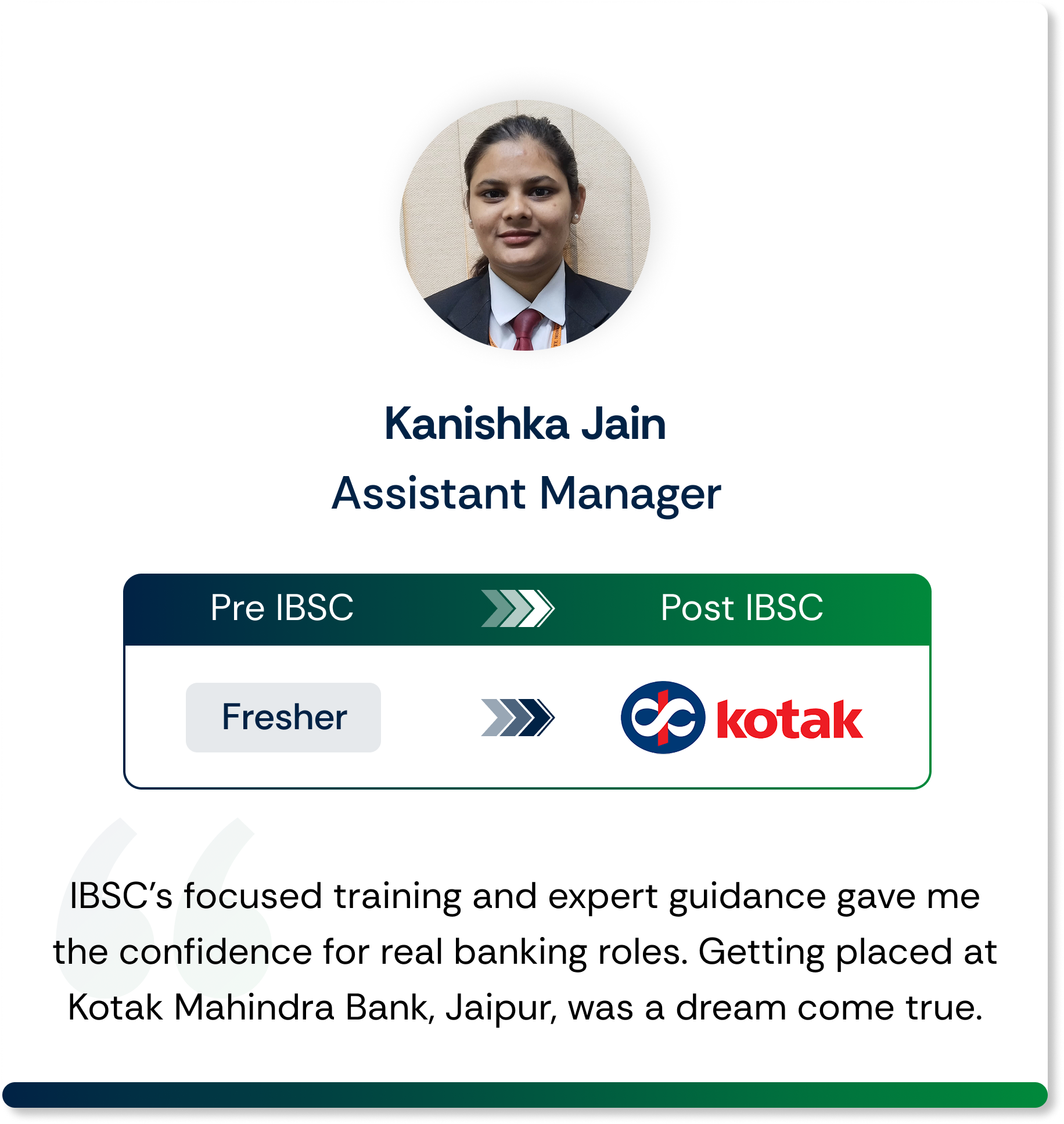

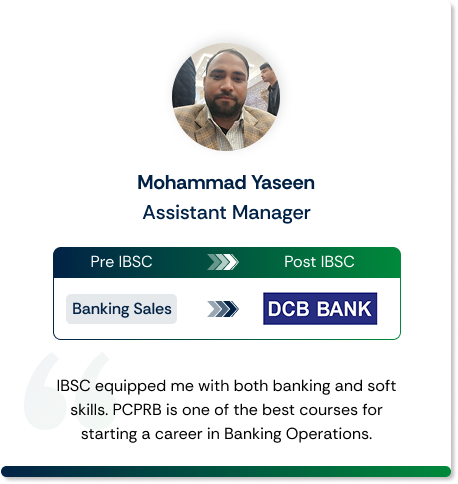

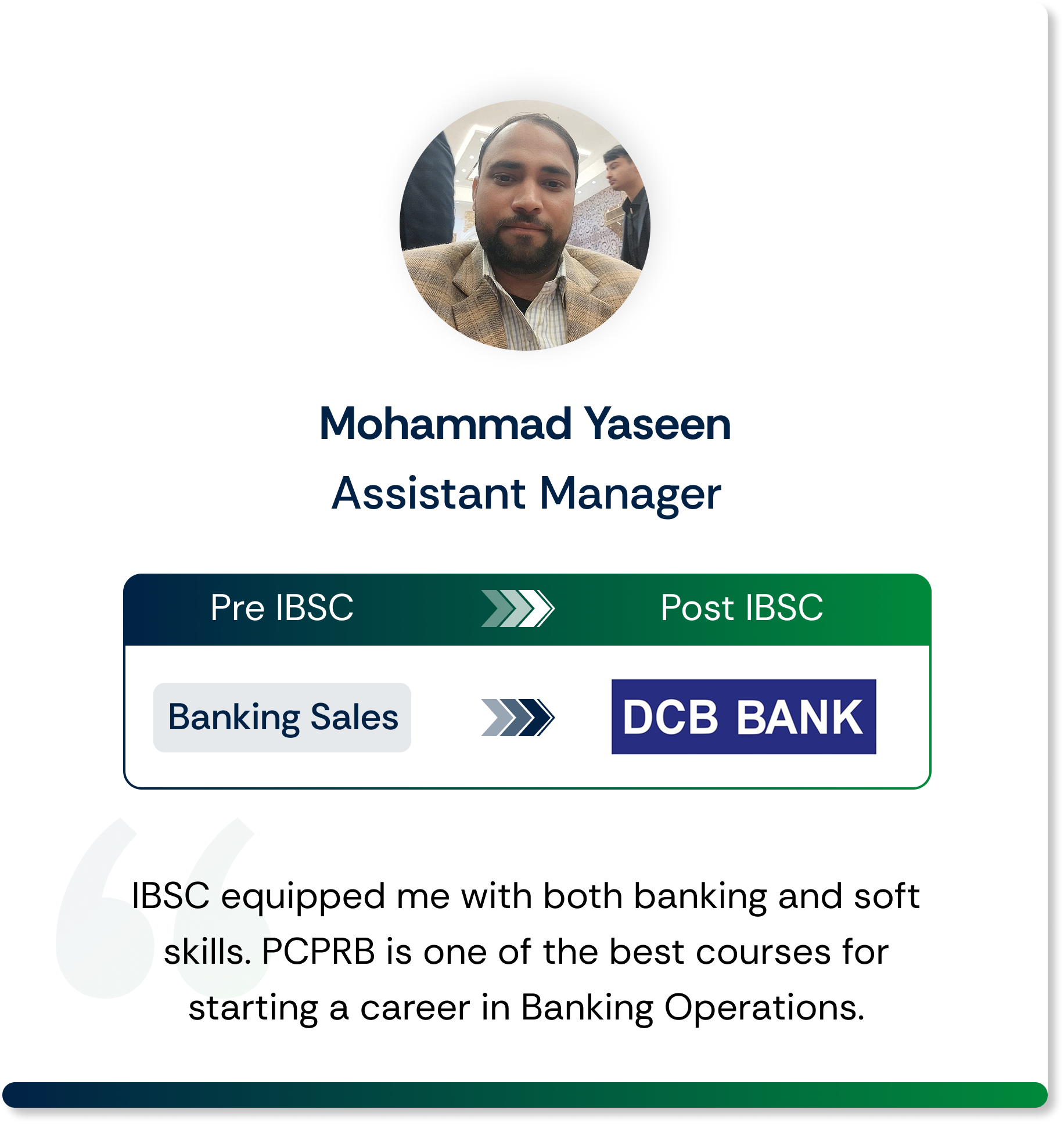

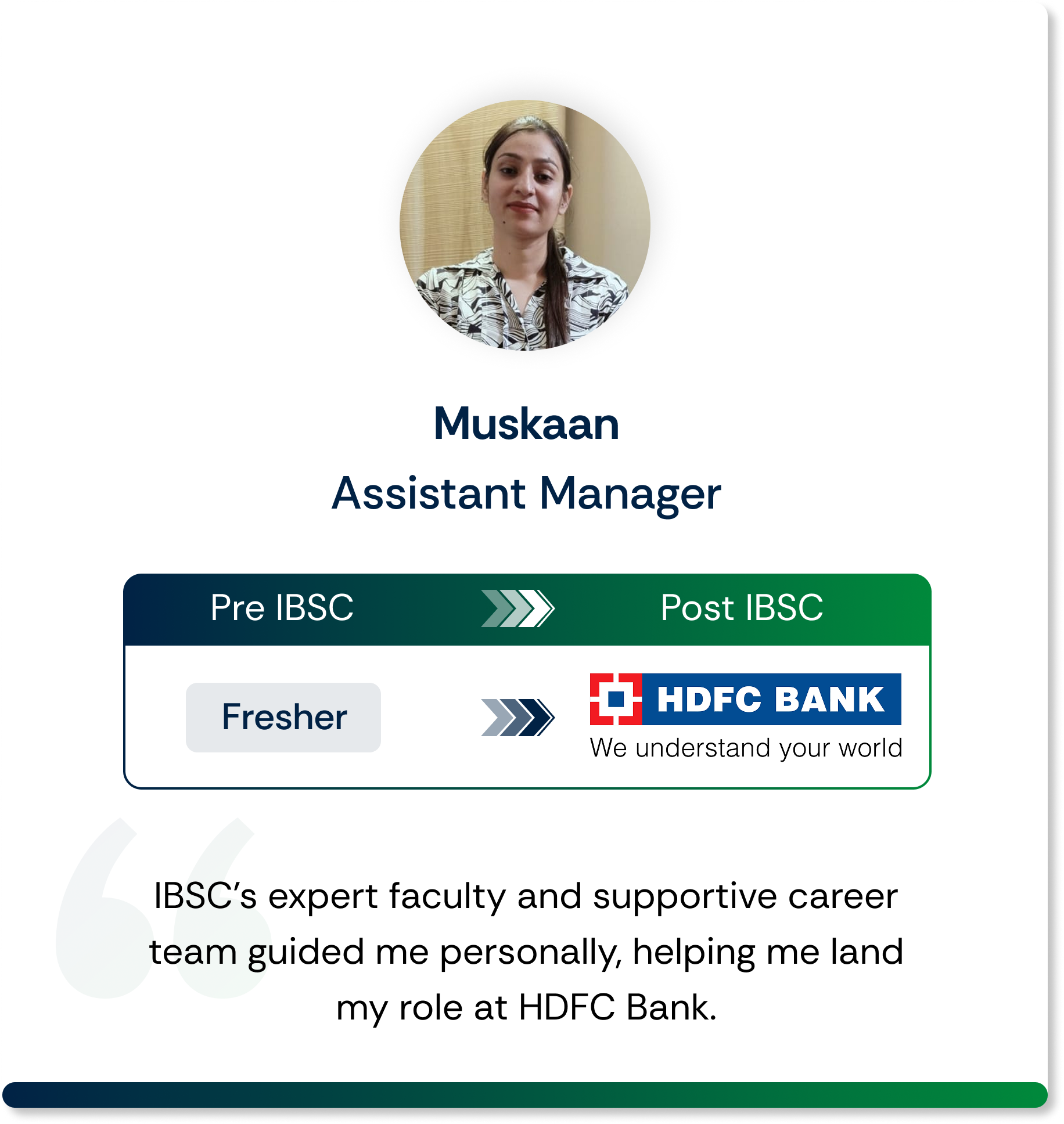

Hear it From Them

Ambitious People ❤️ IBSC

Bridge the gap between education and employment with IBSC!

“Vacancy and salary figures are approximate, based on active job listings and industry research across India and keep on varying from time to time. Actual opportunities and Average Salary (CTC) may vary from Bank to Bank, location, qualifications and economic conditions. Figures are for informational purposes only and do not guarantee employment or salary.

Get Certified & Secure Your Future in Banking

Yes! Upon successful completion of our Professional Certificate Program in Retail Banking, you will receive a prestigious certification from IBSC, in association with BFSI-SSC (BFSI- Sector Skills Council).

Why IBSC Certification?

- Recognized by BFSI-SSC – Get an industry recognized certification

- Boost Your Employability – Stand out in the banking job market.

- Industry-Relevant Training – Practical learning designed for real-world banking careers.

Your journey to a secure banking career starts here!

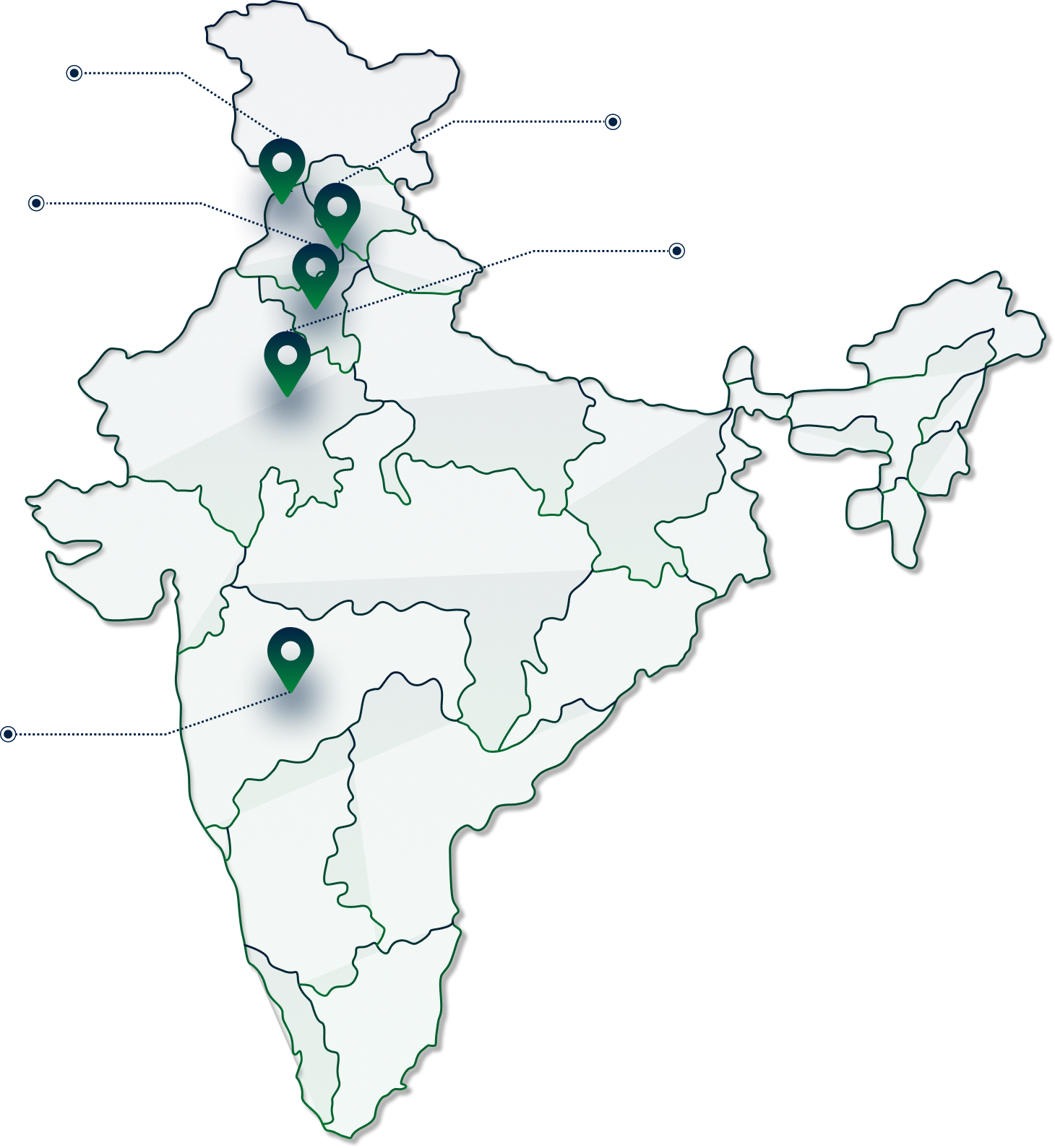

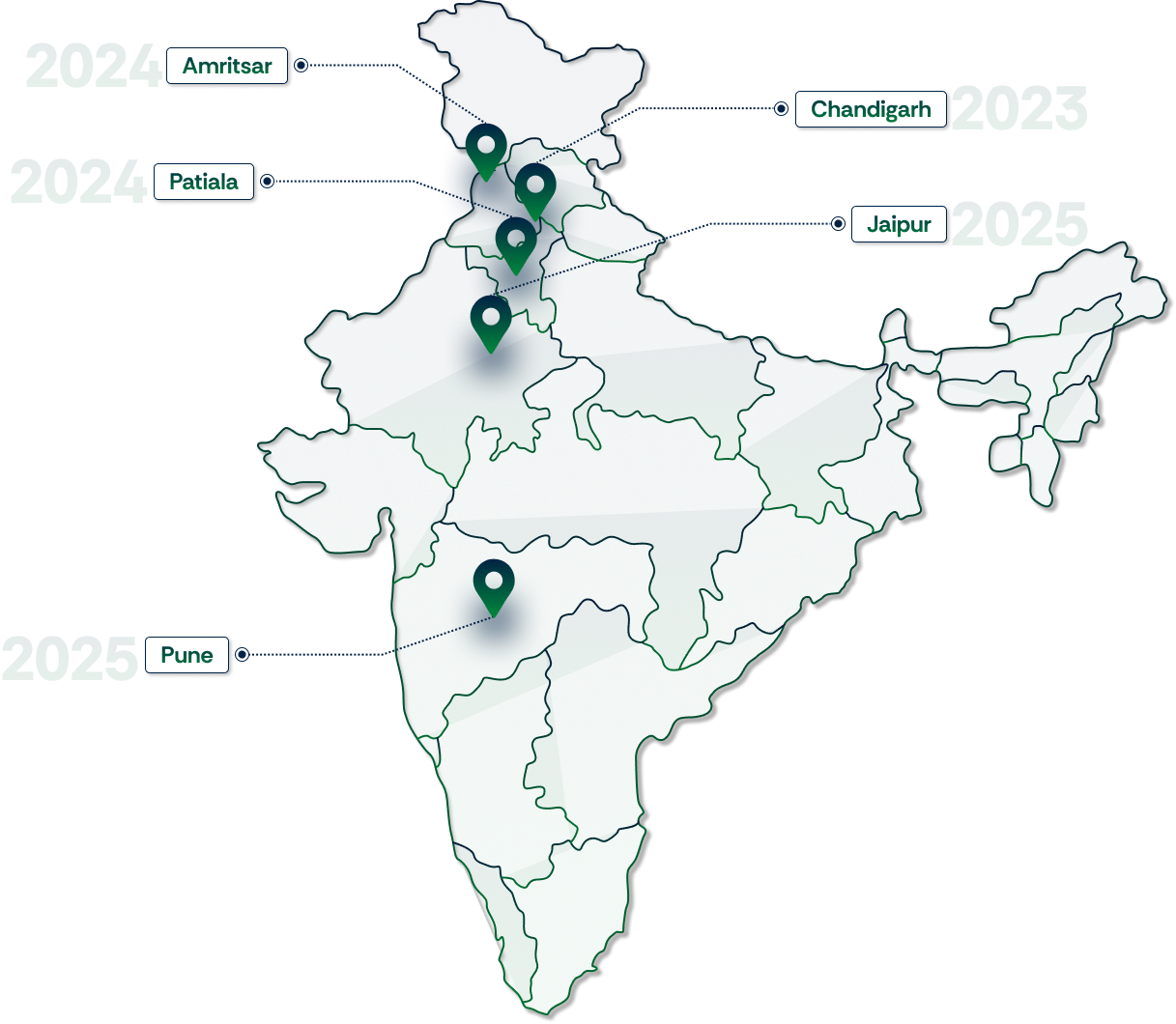

Our Presence

IBSC’s strong presence across cities ensures accessible, industry-relevant banking education. Our

network bridges skill gaps and boosts career opportunities for aspiring professionals nationwide.

Our Presence

IBSC’s strong presence across cities ensures accessible, industry-relevant banking education. Our

network bridges skill gaps and boosts career opportunities for aspiring professionals nationwide.

Frequently Asked Questions

Who can enroll in IBSC’s Banking Courses?

IBSC’s banking and finance courses are open to graduates, job seekers, and working professionals looking to build or switch to a career in the Banking, Financial Services, and Insurance (BFSI) sector. Whether you’re a fresher, a government exam aspirant, or someone looking to upskill, our programs are designed to suit a variety of educational and career backgrounds

Is the course online or offline?

The course is delivered entirely online through live, interactive sessions.

What documents are required for admission?

You’ll need to provide identity proof, educational certificates, experience certificates – if applicable and any additional documents as required during admission process.

How do I enroll in the program?

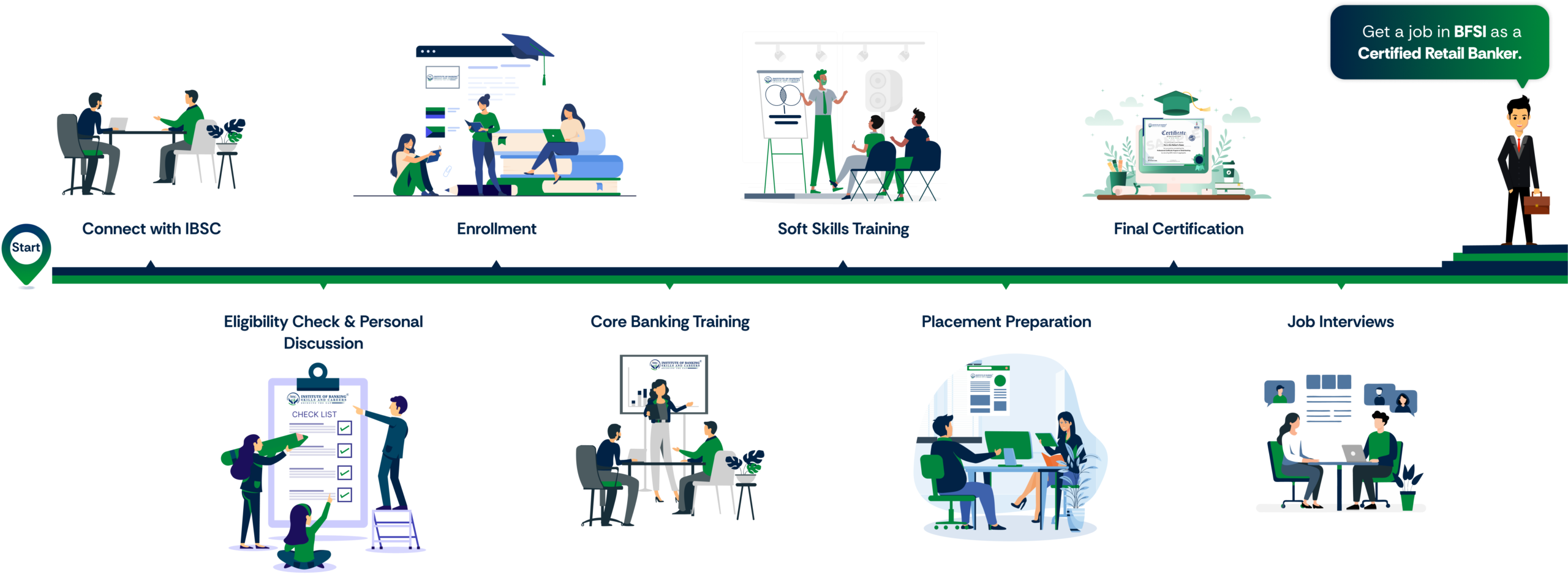

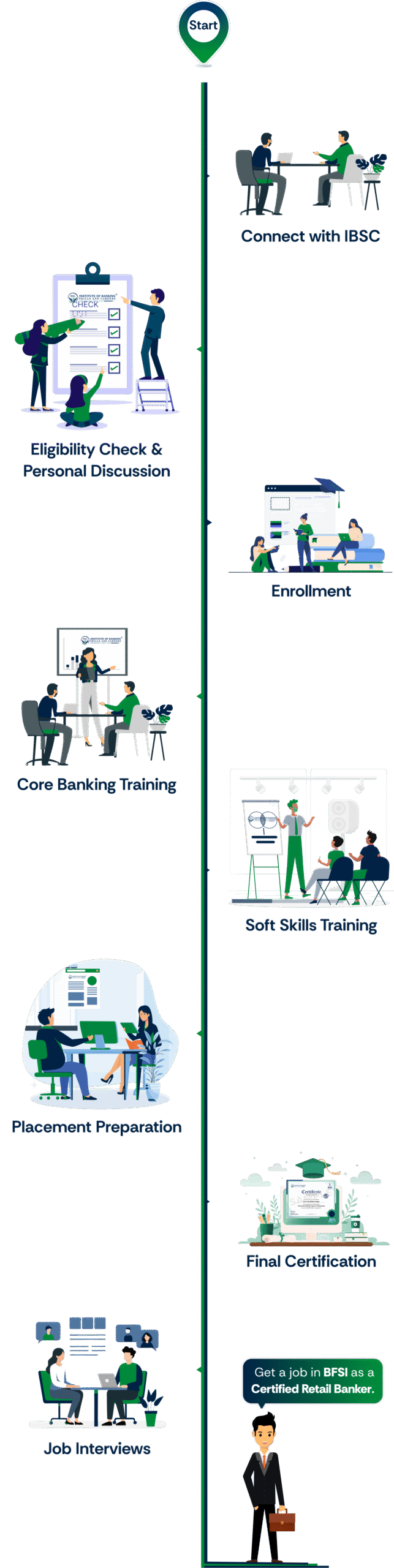

The admission process involves:

- Discussion with our Academic Counsellor

- Application form submission with required documents

- Final screening by an industry expert

- Fee payment

- Batch/ Topic commencement.

Will I receive a certificate after completing the course?

Yes, you will receive a certificate upon successful completion. IBSC is an authorized training partner of BFSI Sector Skills Council (NSDC initiative).

What is the duration of the course?

The course duration is 100 days. New topics begin every Monday.

What are the class timings?

Classes are conducted from 10: 30 AM to 12:30 PM for Morning Sessions and 7:30 PM to 9:30 PM for evening sessions, Monday to Friday.

Can I pay the fee through EMI or any loan option?

Yes, financing is now available through zero-interest EMI options for up to 6 months. This makes it easier for students to pay in flexible installments without any additional cost. For details, please speak to our admissions counsellor.

Does IBSC offer placement support after the course?

Yes, IBSC provides comprehensive placement assistance to all its students. Upon completion of the training program, we offer five guaranteed interview scheduling with leading banks, NBFCs, and other BFSI companies.